The inaugural MUSIC AWARDS JAPAN ceremony, the largest music awards in the country, is set to take place in May in Kyoto. Embodying the theme of “Connecting the world, illuminating the future of music,” the brand-new international music awards is hosted by the Japan Culture and Entertainment Industry Promotion Association (CEIPA), an association jointly established by five major organizations in the Japanese music industry.

This year’s MAJ will recognize works and artists in more than 60 categories, including the six major awards for Song of the Year and Artist of the Year and more, which have gained significant attention and recognition from Jan. 29, 2024 to Jan. 26, 2025. The entries for each category were announced on March 13 and the selection by domestic voting members is currently underway to narrow down the list to five nominees for each category.

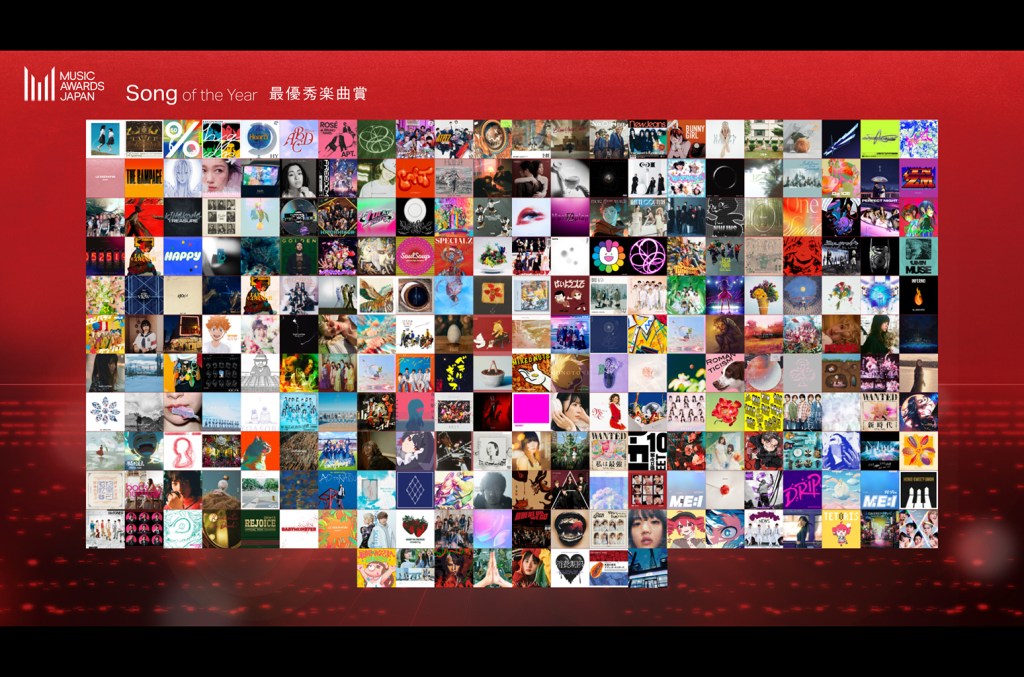

Let’s take a look at the 256 songs that are up for the high-profile Song of the Year category, as compared against Billboard Japan‘s all-genre Japan Hot 100 song chart (hereafter BBJ), and delve deeper into the trends and characteristics unique to MAJ based on data.

Comparison with BBJ Chart Metrics

Billboard Japan

First, we’ll compare some of the differences between the MAJ and BBJ metrics. The chart above shows the point share of each metric for the 256 songs entered in the Song of the Year category. The figures for BBJ show the point share of the top 256 songs in the Japan Hot 100 chart during the same tallying period as MAJ.

The entries for Song of the Year is based on an original chart that combines the six metrics of the Japan Hot 100 (rounded up in two-month segments) and UGC data (click here for details). The system is structured in a way that makes it easier for songs with short peak periods to be eligible.

One feature MAJ and BBJ both have in common is that streaming accounts for the largest proportion of both. This shows that both are strongly aware that streaming is the main way people listen to music today.

CD sales account for 10% of MAJ, but only 2% of BBJ. Japan’s CD sales market is still large when viewed globally, and MAJ places importance on this unique Japanese user trend. Downloads are 7% of MAJ while 4% for BBJ, indicating that the former places a relatively higher value on ownership-type metrics.

While streaming is the main focus for MAJ, they are clearly also conscious of achieving a balance with a wider range of metrics. Its most distinctive feature is that its system is designed to take into account the characteristics of the Japanese market.

Analysis of the Songs’ Properties

Billboard Japan

The gender ratio of the MAJ entries is 61% male artists, 30% female artists, and 9% mixed acts. Compared to BBJ, the ratio of male artists is slightly lower, and the ratio of female artists is higher. BBJ has more mixed acts, mainly because many songs by male-female duo YOASOBI have charted.

84% of the entries were by Japanese artists. Compared to BBJ, MAJ has slightly more songs by South Korean artists (MAJ 14%, BBJ 10%). The only artists from outside Japan and South Korea were Mariah Carey, OneRepublic, and Taylor Swift, all of whom are from the U.S. There were also two entries for collaborations between artists from different countries: Rosé & Bruno Mars and BE:FIRST X ATEEZ.

Billboard Japan

The ratio of member composition of the acts entered in MAJ is highest for groups (37%), followed by bands (27%) and solo artists (26%). Dance and vocal groups, which have strong CD sales, are pushing up the ratio of groups. Meanwhile, BBJ has the highest proportion of bands (36%), influenced by the long-running hits of popular bands such as Mrs. GREEN APPLE and back number. Of the 256 songs, there are 124 acts in MAJ and 103 in BBJ, so the former has a greater variety of acts.

Billboard Japan

The genres with the largest number of songs for both MAJ and BBJ are pop and rock. Notably, K-pop accounts for 14% of MAJ, and idol performers account for 9%, indicating the major influence of dance and vocal groups. Hip-hop and Vocaloid account for less than 10%, but these genres have their own categories, such as the Best Japanese Hip-Hop/Rap Song and the Best Vocaloid Culture Song.

Billboard Japan

43% of the entries weren’t tie-ins, but songs connected to anime (19%), drama series (13%), and commercials (11%) were also prominent. BBJ shows a more continuous tie-in effect, while MAJ can be said to have a diverse collection of songs that are relatively independent of tie-ins.

These data show that MAJ incorporates a good balance of diverse metrics to reflect a wide range of mainstream music in Japan. The fact that the awards also places weight on metrics reflecting the unique characteristics of the Japanese music market, such as CDs and downloads, is a major difference from the BBJ charts.

It’ll be interesting to see how MAJ’s design will impact the future of the music market and the promotion of Japanese music worldwide. The nominated songs will be announced on Apr. 17, and the awards ceremony will take place on May 21 and 22.

Billboard Japan will continue to publish features on MUSIC AWARDS JAPAN. In the second installment, we’ll compare MAJ’s Song of the Year with BBJ’s Top Global Hits from Japan chart.

Comentarios